Legalbook: Financially Secure, Operationally Resilient – LegalBook Banking Solutions

Key Challenges

Banks are also bound by rules and regulation set by boards such as RBI, SEBI and other bodies and authorities of the world. Failure to do so exposes an entity to the legal implications and impacts and other disruptions which will cost 5-7% more in a year, accosting Deloitte.

High frequency of changes to loan documents, services, and internal financial regulation requires substantial involvement of legal services. Research by Gartner shows that about 57% of banking contracts undergo several modifications, which lead to increased risk of issues or inefficiency.

Generally, whenever there is a need for manually conducting a review of all the client contracts like loan or investment, there is always a digestion period. The same report from McKinsey unveiled that more than 40% of banks face approval delays and that affects the customers and the practices in banks.

It is important to conduct proper research for these corporate entities in connection with large banking transactions such as mergers and acquisitions. In its website, PwC stresses that insufficient reviews may cause undiscerned risks, damaging reputation, and transaction holding period.

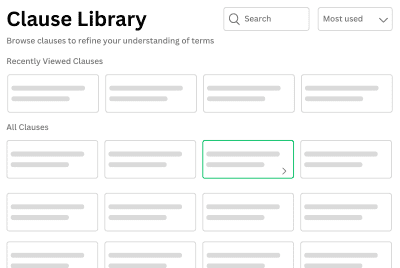

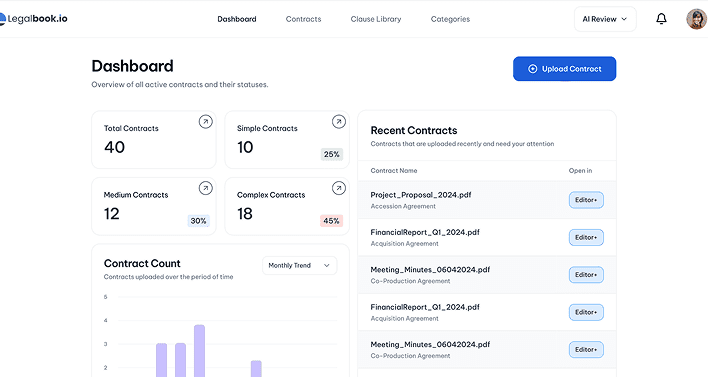

Solutions By LegalBook

Risk Report of Legalbook tracking legal teams with the risk profile of the organisation and the changes in the legislation that they need to know about. This feature also helps to minimize penalties on shells and make sure the organization complies with the mandates ordered by RBI and SEBI.

Auto Redlining and Obligations Mapping ensure the review of common changes to documents such as; loan agreements and customer contracts are automated. This saves up to 45% of the time that is required to perform the review, eliminates errors and Ensures compliance with new terms and condition.

Due Diligence and Contract Summary Tools in Legalbook make complicated transaction reviews easy by searching metadata and providing brief and easy to read summaries. This helps legal departments to discover latent risks and exposures, manage such risks, and provide greater disclosure, all achieved in a time-efficient manner to conduct due diligence.

Metadata Extraction applies to the processing of customer agreements as Legalbook implements Obligations Mapping. This however, cuts down on approval duration thus increasing customer satisfaction as well as general operations. Banks among other financial institutions can therefore ensure that services such as loan disbursement are fast in order to ensure that consumers gain confidence and also encourage more business.

Request A Demo

See it yourself how AI can

transform your

contract management.

Read Our

Stay updated with the latest trends, tips, and insights in business analytics. Explore our curated

articles designed to empower your data-driven journey..