Legalbook: Claims confidence with LegalBook solutions simplified

Key Challenges

This is usually the case with insurance policies that usually need update and revisions to accommodate changes in the laws. According to Gartner, insurance contracts are modified more than 70 percent of the time, which complicates legal tasks and enlarges the possibility of making a mistake.

Compliance requirements that are rigor, for instance as enforced by the IRDAI must be kept on the check all the time. According to Deloitte, the cost of failing to bring the operations into compliance with global standards can cost a company an additional of 3-5% of its operations annually in penalties and disruptions.

This means that manual reviews take a long time to handle all issues to do with claims related contracts and as PwC highlighted 40% of insurers experience this. Consequently, this has a negative effect on customers and increases expense bills.

In reinsurance business, works agreements are complicated, and thus require careful analysis and investigation. Not the required number of reviews can lead to such consequences as additional and unpredictable risks, financial and operational some of which can become critical for the company, as pointed by KPMG.

Solutions By LegalBook

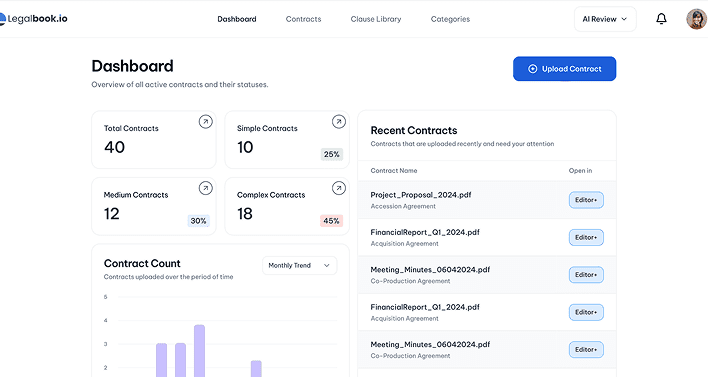

Auto Redlining on Legalbook makes contract reviews easy by alerting users to deviations and demarcating changes on policy amendments. This particular tool cuts review time by a maximum of 40%, ensuring that contracts reflect change in regulations, reducing risks and legal burdens.

The Risk Report feature helps in real time tracking of these regulations and, other mandates set by IRDAI. It fulfils a preventive function by enabling insurers to be aware of changes in regulatory requirements before the latter disrupts the insurers’ operations and increase their non-compliance expenses.

The Legalbook solutions such as Obligations Mapping and Metadata Extraction ensures that the claims related contract review and approval are faster and the claim resolution time shorter. A faster processing system improves the customer satisfaction level and therefore results in a better policy holder satisfaction.

Using Legalbook’s Due Diligence and Contract Summary features, extensive metadata is obtained on reinsurance contract clauses and summary of the contracts is made. This allows detailed work to be done when investigating any company to check for any undetectable risk factors that could affect the company and to as well help adhere to various legal necessities; thus decreasing risks and increasing clarity.

Request A Demo

See it yourself how AI can

transform your

contract management.

Read Our

Stay updated with the latest trends, tips, and insights in business analytics. Explore our curated

articles designed to empower your data-driven journey..